Property Analysis

Commercial / Residential

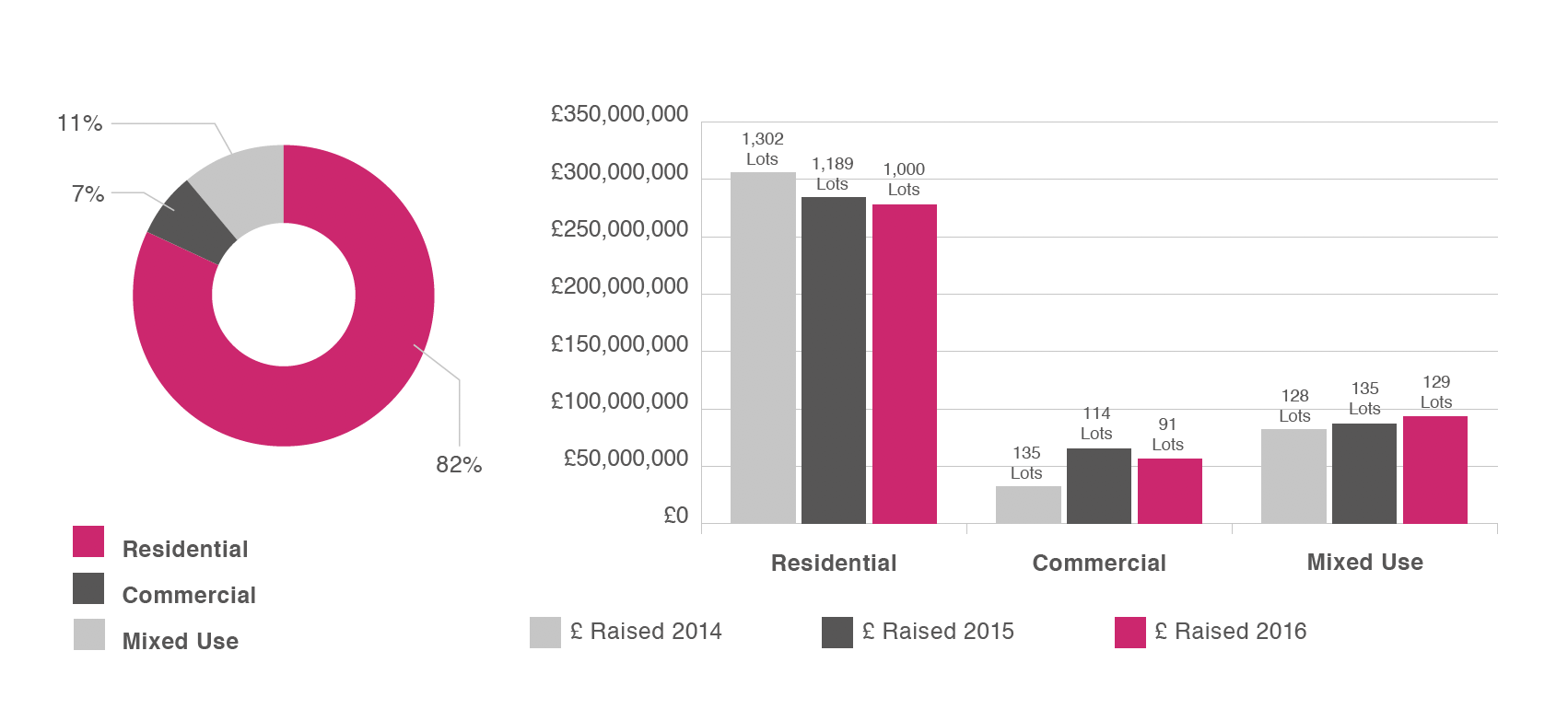

Whilst the proportion of purely residential property coming on to the market remained similar (83% in 2015), a slightly larger offering of mixed use stock came to market both by value and volume. 2015 had seen a sharp rise in the value and volume of commercial lots sold, largely attributable to a healthy supply of, and strong demand for, office buildings with permitted development rights (PDR) for conversion to residential flats. This sector began to cool off in the latter half of last year. Opportunities became scarcer and buyers more discerning. PD is still a popular lot class but sensible pricing will be key in 2017.

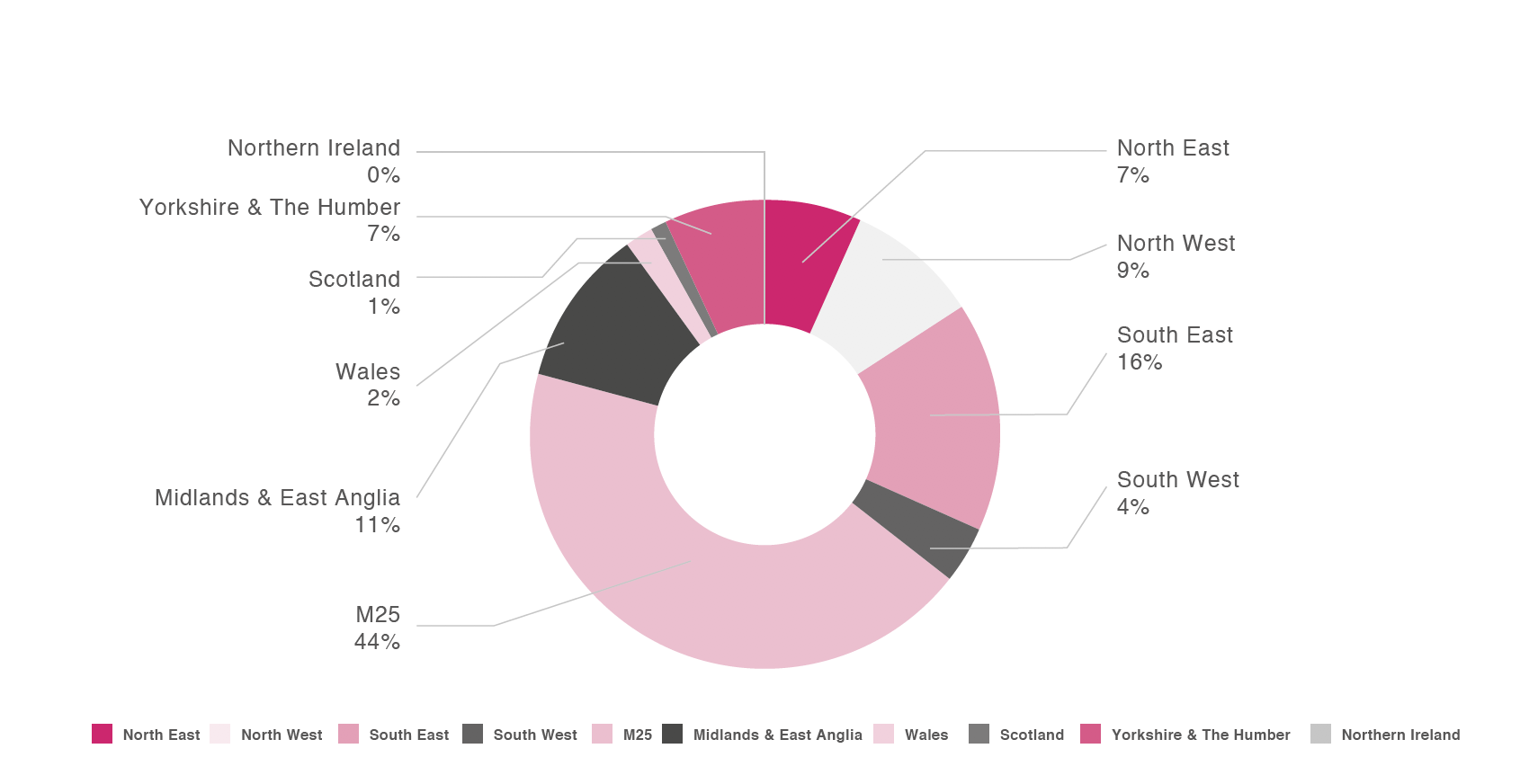

Regional Distribution of Properties Sold in 2016

London was the dominant region of our auction catalogues in 2016. 44% of all lots were located within the M25 and 60% within the South East area overall (up from 56% in 2015). This is consistent with a perceived flight to quality in a more cautious climate.

Yield Analysis

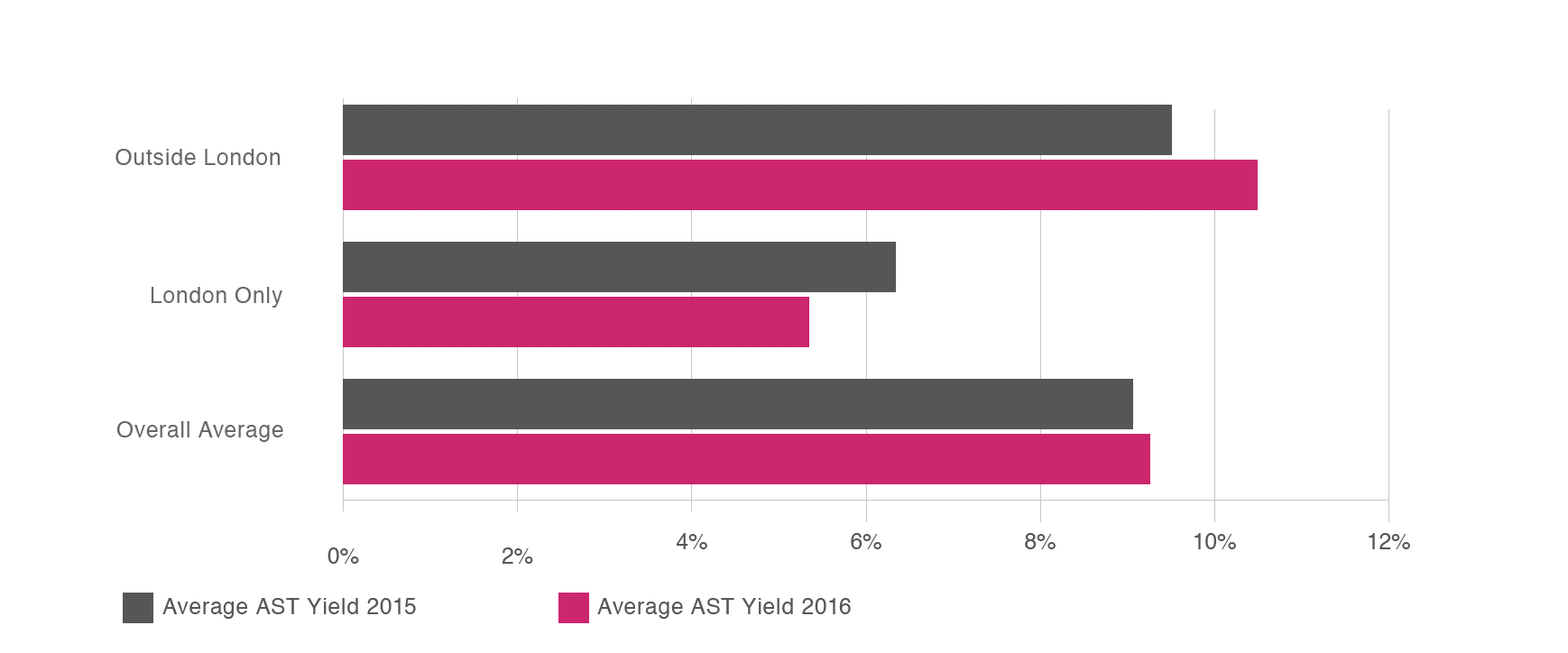

Assured Shorthold Tenancy Yields

Significantly, the average yield from assured shorthold tenancy investments has increased outside London.

However, gross yields in the capital have contracted tojust over 5%. We attribute this primarily to the increased demand for London stock. However, a softening of rental values in London may also be playing a part. Although rental values in the capital are up 2.5% against last year, this is a reduction from the rate of increase seen in October 2015 (7.1%).* Most surveyors continue to report a decline in tenant demand.** During 2016, London went from the region with the second fastest rate of rental growth in Britain to the slowest due to a surge in the number of homes available to rent. Elsewhere in the country however the cost of a new let rose by 3.1%, with the North East, North West and Yorkshire and the Humber regions rising faster than any other.*** *Homelet Rental Index **RICS Residential Market Survey ***Countrywide Lettings Index

Regulated & Ground Rent Yields

Ground Rent Investments

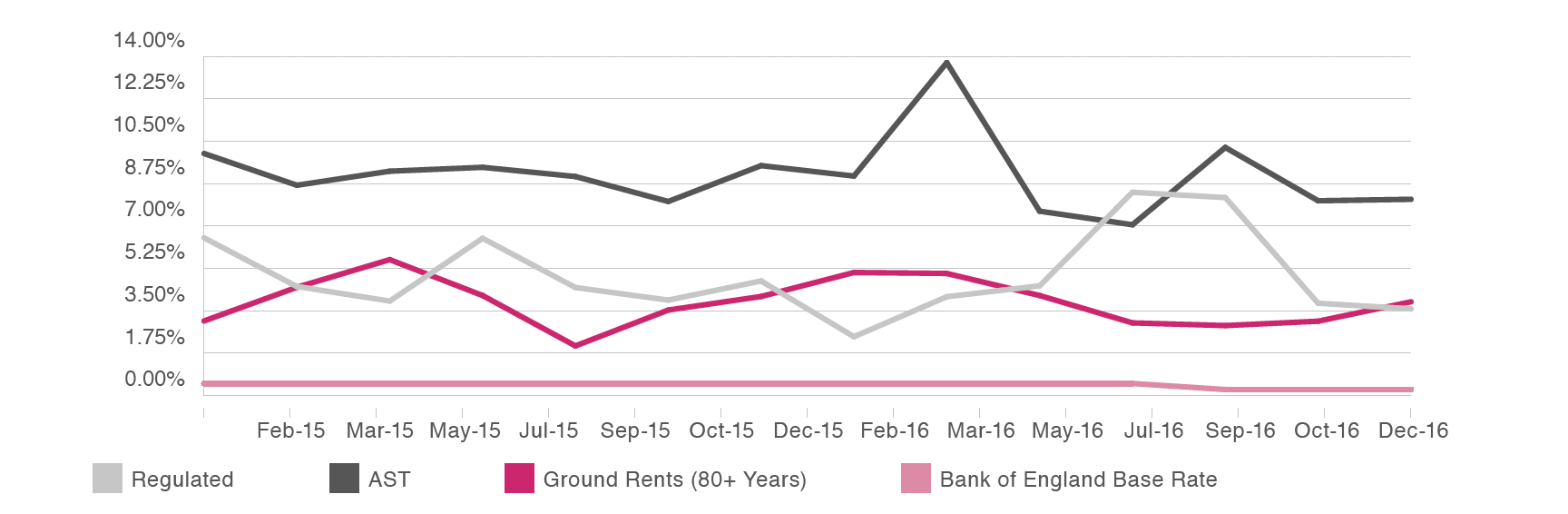

Average ground rent yields per sale have fluctuated within a band of 2% and 6% in 2016 for investments with over 80 years life of income. This is a highly specialised market – but one in which investors have become more knowledgeable and prolific. Two important characteristics of this market are worthy of note.

- Following market research undertaken of Allsop clients and buyers in 2016, it is clear that price is affected significantly by the presence of a nominated purchaser under the Landlord and Tenant Act 1987 (as amended by the Housing Act 1996). We studied 225 transactions of which 33% were sold subject to tenants’ nominations. In those cases, the average price achieved was 12.65 YP (7.9%) down 46% from the 23.44 YP (4.27%) for unaffected sales

- The perception of a reversionary ground rent has shifted. Despite the fact that the Landlord and Tenant Act 1967 will not recognise marriage (reversionary) value, when calculating the statutory price of a lease extension until a lease has less than 80 years to run, our research shows that investors will usually attribute reversionary status to ground rents having less than 100 years unexpired

Regulated Tenancies

Returns largely stayed within a well defined yield band of 4% to 6% in 2015. Last year they were more varied showing lows of 2% and highs of 8%. We attribute this to stronger or weaker reversionary potential presented in different cases.

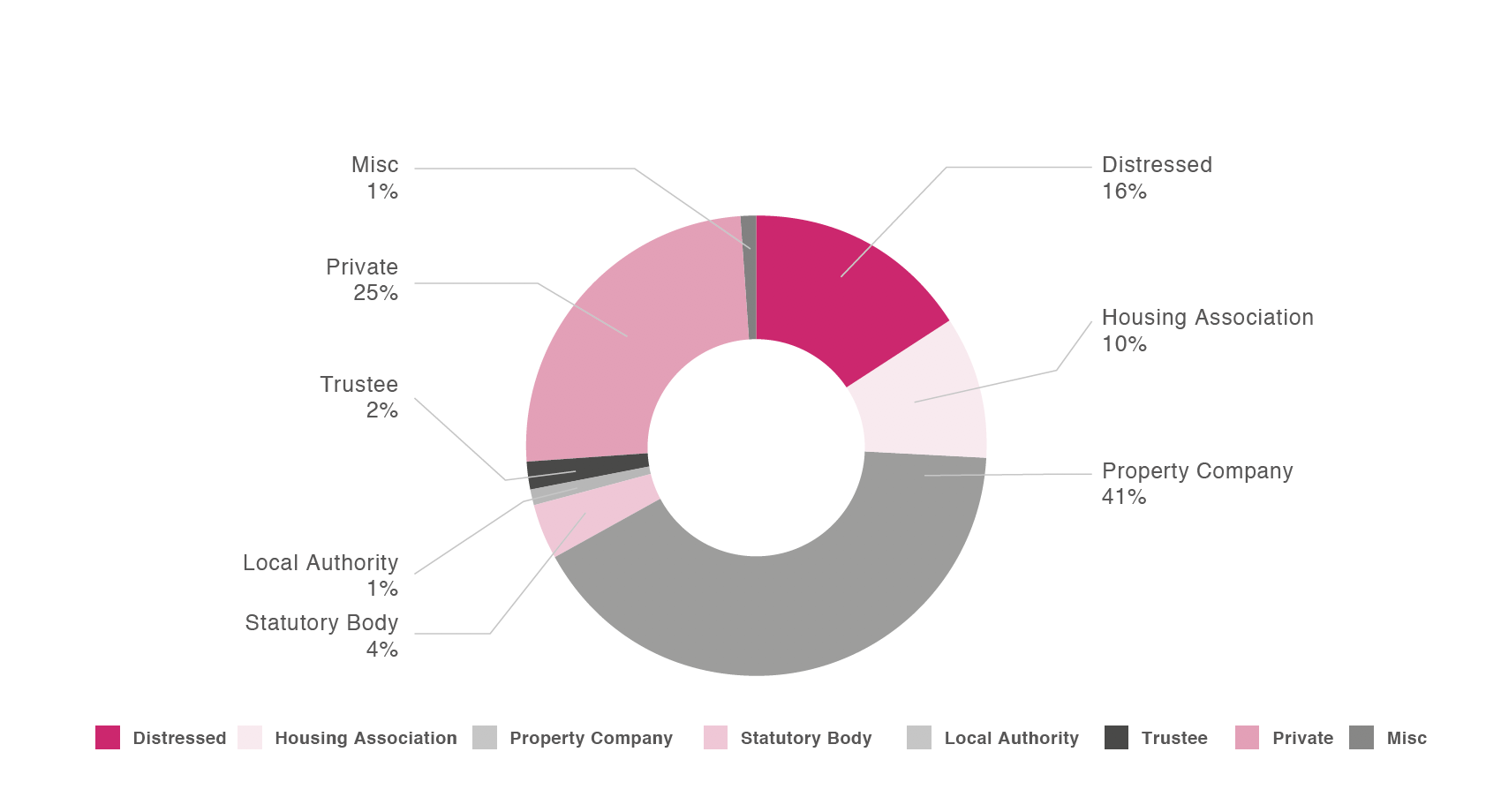

Vendor Analysis

The proportion of distressed stock offered at our sales has fallen from around a quarter in 2015 to 16% in 2016. This is consistent with a healthier economic climate and a sustained low interest rate environment.

Over 41% of lots were contributed by property companies, by far the most prominent vendor class, realising almost £216m in sales revenue – almost half the total for the year. The private investor continued to

contribute a quarter of all lots to the sales. With a third of sales coming from these sources, it is apparent that confidence in property trading, and auctions in particular, remained robust.

Outlook for 2017

Although there is no shortage of significant UK and world events capable of influencing markets in 2017, the auction room – and the sub £5m markets which power it – is expected to remain active and ripe with opportunity

as a result.

Donald Trump will be US President from 20 January. If his behaviour in office is as erratic as during his campaign, we are in for many surprises. The full impact of Brexit will only be realised over an extended period – and nobody can accurately forecast the extent of its effect on markets, property prices, trade deals, in fact anything, nor indeed the duration of so many fundamental post Brexit adjustments. Theresa May has promised that Article 50 will be invoked before April thereby starting the formal process for Britain’s withdrawal from the EU. Although the auction rooms appeared to have been largely unaffected post referendum, there is no guarantee that this sustained confidence will continue after a formal Brexit. And there is no apparent Government plan to help any forecasts. Philip Hammond’s spring budget is unlikely to ease the pain inflicted on buy to let investors during 2016. The 3% stamp duty surcharge on investments and second homes appears to be here to stay. In addition, the first phase of reductions in tax relief kicks in from 1 April when landlords will only be entitled to deduct 75% of finance costs from rental income. We have seen some residential investors turn their attention to commercial or mixed use buildings as a result of the lower taxation in this sector.

Developers in London will have to assess the increased requirement of 35% affordable housing provision (although not the original 50% proposed by the Mayor). This is likely to have an impact on site values.

The prime central London market (£5m+) faces challenges and will be one of the UK residential sectors with the lowest growth on average. There is likely to be further stagnation – or price falls – in the £10m+ markets, although this will have little impact on the auctions. There will certainly be buying opportunities later in the year. A weak post Brexit pound – now at its lowest level since 1985 – has encouraged overseas investment. The UK is still seen as a safe haven. Major conurbations outside London, particularly those with strong tenant demand, are the areas to watch. 2015 belonged to London, 2016 was arguably a year of transition – but 2017 will be the year for UK cities. Birmingham, Manchester and Leeds, for example, will offer great value for money, decent yields and the prospect of good capital growth. The UK is still experiencing record low interest rates, low inflation, a stock market that has repeatedly tested new highs and, above all, an embedded mentality of property investment and aspiration to ownership. “Generation Rent” will ensure a sustained, if partially reluctant, tenant pool. London rents will rise at a softer pace this year but other major cities should see healthy rental growth. Investors will still face competition from first time buyers and owner occupiers with access to finance and the “bank of mum and dad”. Ground rents will continue to be seen as secure long term investments. This market is very specialised but one that is growing in popularity as investors become more educated. Buyers should look out for lots that are subject to lessee nominations under the Landlord and Tenant Act.

Research shows that these can be bought at reduced prices. The sector has however been the subject of parliamentary debate. Expect government intervention and further regulation in the future. The year ahead should be one of slow steady growth overall. The significant identifiable events ahead will inevitably lead to some caution and market ripples. But these are where the astute will identify buying opportunities. The auction room will be where these opportunities will be immediately manifested. And as always, Allsop will be endeavouring to ensure that reserves remain realistic in order to allow the broadest participation of bidders.